Filter by

Cambodian Dollarization: Its Policy Implications for LDCs’ Financial Develo…

This book is the first study to provide a comprehensive picture of the reality and structure of dollarization in Cambodia, which has been achieving rapid economic and financial development since the end of 1998, when full piece reigned over the kingdom. It uses the micro-level data collected through nationwide surveys conducted jointly by the National Bank of Cambodia and JICA Ogata Sadako Rese…

- Edition

- -

- ISBN/ISSN

- 9781000955552

- Collation

- -

- Series Title

- -

- Call Number

- -

Modern Cryptography Volume 2

This open access book covers the most cutting-edge and hot research topics and fields of post-quantum cryptography. The main purpose of this book is to focus on the computational complexity theory of lattice ciphers, especially the reduction principle of Ajtai, in order to fill the gap that post-quantum ciphers focus on the implementation of encryption and decryption algorithms, but the theoret…

- Edition

- 1

- ISBN/ISSN

- -

- Collation

- -

- Series Title

- Financial Mathematics and Fintech

- Call Number

- XI, 191

The Future of Financial Systems in the Digital Age

This book is open access, which means that you have free and unlimited access. The increasing capacity of digital networks and computing power, together with the resulting connectivity and availability of “big data”, are impacting financial systems worldwide with rapidly advancing deep-learning algorithms and distributed ledger technologies. They transform the structure and performance o…

- Edition

- -

- ISBN/ISSN

- 978-981-16-7832-5

- Collation

- -

- Series Title

- -

- Call Number

- -

Public Financial Management and Internal Control

This open access book focuses on the ‘downstream’ element of PFM, that is how public organisations utilise public resources. It argues that improvements in PFM/IC will only flow from a recognition that what really matters is the quality of management. Management reform is an essential precondition to the successful implementation of many new techniques. Only when a managerial capacity exis…

- Edition

- -

- ISBN/ISSN

- 978-3-031-35065-8

- Collation

- XXIII, 579

- Series Title

- -

- Call Number

- -

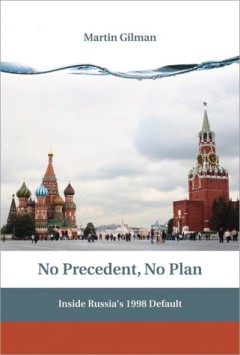

No precedent, no plan: Inside Russia's 1998 default

The definitive insider's account of Russia's painful transition to a market economy, as told by the IMF's senior man in Moscow at the time.OCLC-licensed vendor bibliographic record.

- Edition

- -

- ISBN/ISSN

- 9780262289429

- Collation

- 1 online resource (xx, 331 pages) :illustrations

- Series Title

- -

- Call Number

- -

The Empire of Value: A New Foundation for Economics

Translation of the author's L'empire de la valeur."With the advent of the 2007-2008 financial crisis, the economics profession itself entered into a crisis of legitimacy from which it has yet to emerge. Despite the obviousness of their failures, however, economists continue to rely on the same methods and to proceed from the same underlying assumptions. Andr?e Orl?ean challenges the neoclassica…

- Edition

- -

- ISBN/ISSN

- 9780262323901

- Collation

- 1 online resource (x, 350 pages) :illustrations

- Series Title

- -

- Call Number

- -

The Economics of Risk and Time

This book updates and advances the theory of expected utility as applied to risk analysis and financial decision making. Von Neumann and Morgenstern pioneered the use of expected utility theory in the 1940s, but most utility functions used in financial management are still relatively simplistic and assume a mean-variance world. Taking into account recent advances in the economics of risk and un…

- Edition

- -

- ISBN/ISSN

- 9780262274043

- Collation

- 1 online resource (xx, 445 pages) :illustrations

- Series Title

- -

- Call Number

- -

Banking the World: Empirical Foundations of Financial Inclusion

About 2.5 billion adults, just over half the world's adult population, lack bank accounts. If we are to realize the goal of extending banking and other financial services to this vast "unbanked" population, we need to consider not only such product innovations as microfinance and mobile banking but also issues of data accuracy, impact assessment, risk mitigation, technology adaptation, financia…

- Edition

- -

- ISBN/ISSN

- 0262305992

- Collation

- 1 online resource (vi, 511 pages)

- Series Title

- -

- Call Number

- -

In the Wake of the Crisis: Leading Economists Reassess Economic Policy

Conference proceedings.In 2011, the International Monetary Fund invited prominent economists and economic policy makers to consider the brave new world of the post-crisis global economy. The result is a book that captures the state of macroeconomic thinking at a transformational moment. The crisis and the weak recovery that has followed raise fundamental questions concerning macroeconomics and …

- Edition

- -

- ISBN/ISSN

- 9780262301831

- Collation

- 1 online resource (x, 239 pages) :illustrations

- Series Title

- -

- Call Number

- -

Emerging Capital Markets in Turmoil: Bad Luck or Bad Policy?

Analysis of financial crises in emerging market economies, including Mexico, Argentina, and Russia; traces the evolution of crisis theory and challenges the conventional wisdom.Since the mid-1990s, emerging market economies have been hit by dramatic highs and lows: lifted by large capital inflows, then plunged into chaos by constrained credit and out-of-control exchange rates. The conventional …

- Edition

- -

- ISBN/ISSN

- 9780262269728

- Collation

- 1 online resource (xiii, 547 pages) :illustrations

- Series Title

- -

- Call Number

- -

Computer Science, Information & General Works

Computer Science, Information & General Works  Philosophy & Psychology

Philosophy & Psychology  Religion

Religion  Social Sciences

Social Sciences  Language

Language  Pure Science

Pure Science  Applied Sciences

Applied Sciences  Art & Recreation

Art & Recreation  Literature

Literature  History & Geography

History & Geography